PM Youth Business And Agriculture Loan Scheme

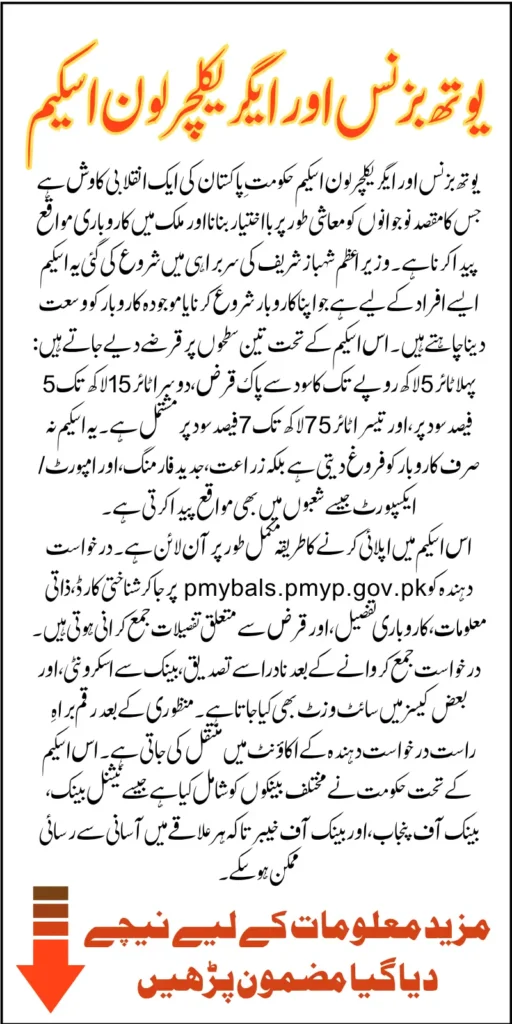

PM Youth Business And Agriculture Loan Scheme: The Government of Pakistan has launched the PM Youth Business and Agriculture Loan Scheme. This scheme provides easy-access business and agriculture loans to Pakistani citizens, especially those looking to start or expand their ventures. With loan amounts of up to 7.5 million and 0% interest on smaller loans under Tier 1, this scheme promises to significantly reshape the economic landscape for aspiring entrepreneurs and farmers.

This article explains everything in detail, including who can apply, how to apply, required documents, and how to track your application. Whether you want to start a business, boost your farming income, or enter the import/export sector, this guide gives you the complete process step-by-step.

You Can Also Read: BISP 8171 Payment Eligibility PMT Score Check Before Widrawal Know Full Details 2025

Purpose and Vision Behind the Scheme

The PM Youth Business and Agriculture Loan Scheme aims to make young individuals economically independent. It focuses on creating opportunities and supporting the growth of small to medium businesses.

- Strengthen Pakistan’s economy by encouraging entrepreneurship

- Support agricultural development and modern farming techniques

- Promote import/export businesses to enhance international trade

- Generate employment opportunities for thousands of youth across Pakistan

The government believes that supporting young people can help improve the country’s economy. Giving easy and low-interest loans is a way to help.

You Can Also Read: Punjab Districts BISP July 2025 Payments Distribution Start Know Full Details Step By Step

Eligibility Criteria For Loan Application By PM

To ensure that loans reach those who can genuinely benefit, the government has outlined strict eligibility criteria.

- Age Requirements:

- 21 to 45 years for general business loans

- Minimum 18 years for IT and e-commerce startups

- Nationality:

- Must be a Pakistani citizen

- Dual nationality holders are not eligible

- Employment Status:

- Government employees are not eligible to apply

- CNIC:

- A valid CNIC issued by NADRA is mandatory

- Education:

- No minimum education required; however, having a degree or technical training can be an advantage

This broad eligibility criterion ensures that both educated and skilled workers from rural and urban areas can benefit.

You Can Also Read: Government Employs Not Eligible for BISP Aid Official Recovery Message Issued

How Much Can You Get a Loan Under the PM Loan Scheme?

The PM Youth Business and Agriculture Loan Scheme is structured into three distinct tiers. Each tier offers varying amounts and markup rates depending on the size and purpose of the business:

| Tier | Loan Amount | Markup Rate |

|---|---|---|

| 1 | Up to Rs. 500,000 | 0% (Interest-Free) |

| 2 | Rs. 500,001 – Rs. 1.5 million | 5% |

| 3 | Rs. 1.5 million – Rs. 7.5 million | 7% |

Tier 1 loans are ideal for small or home-based startups, offering interest-free support. Tier 3 loans suit larger businesses or agricultural projects needing more capital.

You Can Also Read: Benazir Kafalat Eligibility Details For Unverified Women

Step-by-Step Online Registration Process

You must apply online through the official portal to benefit from this scheme. Here’s a simplified breakdown of the application process

- Go to pmybals.pmyp.gov.pk to access the loan application portal.

- Input your CNIC number, CNIC issue date, and select the relevant loan tier.

- Click on the enter button to open and begin the application form.

- Fill in your full name, father’s name, date of birth, CNIC front and back images, marital status, religion, address, contact numbers, and monthly income and expenses.

- Enter business name, choose business sector, location, experience, and monthly income. Upload supporting documents if available.

- Specify the loan amount, tenure, and clearly state the purpose of the loan.

Choose your repayment method and preferred installment plan. - Accept the terms and click submit to finalize your loan application.

Once submitted, your application will be forwarded to the verification phase.

You Can Also Read: BISP Sindh Districts Payment Phase-Wise List Know Withdrawal Method To Receive 13500

Documents Required for Loan Application

Make sure to prepare and upload the following:

- CNIC front and back images

- Recent passport-sized photo

- Household utility bills

- Degree/diploma or certificate of skill

All uploaded images must be clear and under the file size limit prescribed on the portal.

What Happens After Application?

After submitting your application, it goes through several verification and approval stages before the loan is granted. These steps ensure that only eligible and genuine applicants receive financial support.

- Verification by NADRA: Your CNIC and submitted details are verified

- Scrutiny by Lending Bank: The bank assesses the feasibility and approves or rejects the loan

- Physical Inspection: Some applications, especially for higher tiers, may be subject to site visits

- Loan Disbursement: Once approved, the loan amount is disbursed directly into the applicant’s bank account

The entire process can take a few weeks, depending on the loan tier and verification requirements.

You Can Also Read: BISP Balance Check July 2025 Using 8171 Updated Web Portal SMS Using CNIC

Partner Banks in the Loan Scheme

Several major banks are participating in this scheme to ensure broad access across the country:

- Bank of Punjab

- National Bank of Pakistan

- Askari Bank

- Habib Bank Limited

- Bank Al Habib

- Bank of Khyber

You will be assigned one of these banks based on your location and application details.

You Can Also Read: BISP Payment Increase 2026 Latest Update On New Amount And Who Will Receive 14500

Government Helplines for Regional Support

If you face any issues during application or need clarification, you can contact:

- Punjab: (042) 111-111-456, 99204701-12

- KPK: (091)-111-111-456, 091-9213046-7

- Balochistan: (081)-2831623 – 2831702

- Sindh: (021)-111-111-456

These helplines are managed by trained representatives who can guide you through any difficulty.

You Can Also Read: BISP 8171 Portal Update July 2025 To Check New Payment in 2025 Know Full Details

Conclusion

The PM Youth Business and Agriculture Loan Scheme is a powerful step toward empowering Pakistan’s youth. With interest-free and low-interest loans, it opens doors for aspiring entrepreneurs and farmers who have the vision but lack financial support. Whether you want to start a small home-based setup or grow a large farming business, this scheme gives you a solid foundation to succeed.

By following the simple online application process and meeting the eligibility criteria, you can access funds that can transform your business dreams into reality.

You Can Also Read: Sindh Districts July 2025 BISP Payment Complete Guide

FAQs

Can government employees apply?

No, the scheme is only for private individuals. Government employees are ineligible.

Can someone below 21 apply?

Yes, but only if the business is related to IT or e-commerce. The minimum age is 18 in that case.

How long will it take to get the loan?

Depending on the verification process, it may take 4 to 8 weeks.

Can I use the loan for agriculture machinery?

Yes, agriculture-related investments like equipment, seeds, or livestock are allowed.